Leading Platform for Legal, Tax & Compliance Services in India

Simplifying Legal, Tax & Compliance for Startups and Businesses

1,000+ Startups

4.7/5 Google Review

100% Satisfaction

Explore Our Smart Solutions for Modern Businesses

Grow your business and stay compliant with NextFilings.

Spend less, do more

SmartClaim

Optimize accuracy, speed up processes, and boost overall productivity.

Connect with Tax Pros

Get personalized advice from India’s leading tax consultants.

Business Suite

All-in-one solutions for GST, e-Invoicing, and corporate compliance.

Need professional assistance?

Need professional assistance?

Get expert support to handle your tasks efficiently and confidently.

Tailored for You

Expert ITR Filing Assistance

Let our experts handle your ITR filing—quick, accurate, and tailored for salaried, self-employed, NRIs, and capital gains.

TDS Rules for Selling Property

When selling property over ₹50 lakhs, 1% TDS is deducted by the buyer and paid to the government via Form 26QB.

Professional Legal Help

Drafting legal documents, reviewing paperwork, updating company names, and related services.

For Your Business

Build and grow your startup.

Expert support for legal drafting, document checks, company name updates, and more corporate legal needs.

Government permits and registrations.

Shop license, PF, PAN, FSSAI registrations and

more made easy.

Trademark registration and digital signatures.

Trademark filing and renewals; digital signature

certificates.

Dedicated to ensuring security.

We treat your data with the same care as our own. Our certifications and licenses, including GSP, were granted following

thorough system evaluations and multiple VAPT audits.

Dedicated to ensuring security.

Looking to cut taxes in India? Save up to ₹1.5 lakh under Section 80C, claim benefits for health insurance (80D), home loan interest (24b), and education loans (80E). Get extra deductions on NPS (₹50,000), HRA, and a ₹50,000 standard deduction for salaried individuals. Plan ahead for a hassle-free tax season.

Link your Aadhaar with PAN easily on the income tax e-filing portal. Log in, enter PAN, Aadhaar, and name, verify with OTP, and submit to avoid penalties or PAN deactivation.

For FY 2024–25, the new tax regime is default, with lower rates and fewer exemptions. Income up to ₹12 lakh gets a full rebate under Section 87A. Rates range from 0% to 30% above ₹24 lakh. The old regime offers more exemptions, especially for seniors. Choose the regime that suits you best.

After filing your ITR, log in to the e-filing portal, select ‘e-Verify Return,’ choose your ITR, and verify via Aadhaar OTP, net banking, or EVC to complete verification.

How It Works

Industry leading partnerships

We work with top Indian Institutions to further our shared mission of improving ease of doing business and promoting Entrepreneurship in India.

Enterprise Partnership

If you’re an independent professional, firm, enterprise client, bank, or government organization, we invite you to reach out to our Enterprise Partnership Team. Our dedicated Enterprise Team is committed to collaborating with a diverse range of clients including professionals, banks, enterprise clients, and government departments to create customized solutions that meet specific requirements. Contact us today to explore partnership opportunities to work together and create value.

Popular Services

One Person Company | Company Registration | Tax Notice | Indian Subsidiary | HSN Code | Section 8 Company | Trademark Search | USA Company Registration | FSSAI Registration | Import Export Code | ESI Registration | Proprietorship | GST Return Filing | PF Registration | Payroll | Business Tax Return Filing | PF Return Filing | Eway Bill | GST Registration | TDS Filing | Udyam Registration | Trademark Registration | Startup India Registration | Professional Tax | Personal Tax Filing | Check Company or LLP name Availability | Online Lawyer Consultation | Online CA Consultation | Business Consultation |

Popular Searches

Partnership | Limited Liability Partnership | Digital Signature | Copyright Registration | Unified Portal | PAN Card Download | Nadakacheri | Flipkart Seller | Caste Certificate | IAY | EPFO Passbook | Domicile Certificate | Udyog Aadhaar | PF Withdrawal | Karnataka One | Encumbrance Certificate | Bonafide Certificate | Instant PAN Card | E PAN Card | Income Certificate | Marriage Certificate | Passport Renewal | Nivesh Mitra | MSME Registration | Experience Certificate | Trademark Status | Trade License | Domicile | eMitra | UAN | PICME | Resignation Letter Format | Ration Card | TNREGINET | RAJSSP | LLP Compliance | Form 16 | Police Clearance Certificate | OBC Certificate | Jamabandi | Mee Bhoomi | SC Certificate | UAN Login | eAadhaar Download | Linking Aadhaar To Bank Accounts | mAadhaar | Aadhaar Enrollment Centre | UAN Passbook | Amazon How to Sell | PAN Card Apply | EPFO Unified Portal |

nextFilings

About NextFilings

Online Payment

Careers

Contact Us

Platforms

Business Search

Trademark Search

Client Portal

Filings.AE for UAE

Usage

Terms & Conditions

Privacy Policy

Refund Policy

Confidentiality Policy

Disclaimer Policy

NextFilings Review

versatile app for smart solutions

we build a digital experience

Duis gravida augue velit eu dignissim felis pos

quis. Integ ante urna gravida nec molestie.

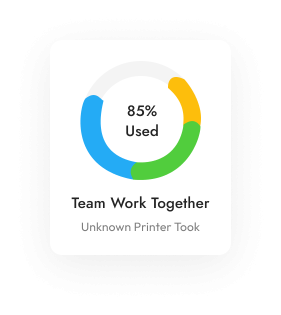

active user analytics

smart coding development

Apptek is partnered with 10k+ fastest growing companies